Ethereum 2.0

We have always been big fans of Ethereum, and we've been on the lucky side to have invested into this idea early on. When the second big bubble of crypto was about to pop, disillusionment and doubts lured behind the corner:

The technology that was supposed to help people was slowly turning against them. With its high volatility, Ethereum didn't catch up on replacing money. At the same time, there were technological problems: The main consensus algorithm for Ethereum is still Proof of Work, a mathematical riddle that protects the network from malicious players but it's also almost eating up the same electricity as the country Bolivia — in times of climate change, this is a really bad thing. So after the Party came a long hangover. Compared to its price, the ideas of Ethereum, its pitch and promises haven't really changed. Among other, the steadfastness of the Ethereum Leadership, something rarely seen in the crypto-sphere, has helped to slowly unlock its potential.

Hello DeFi

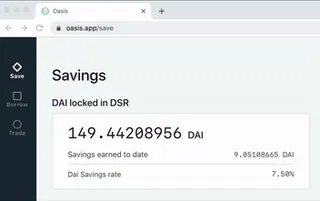

To counter the volatility problem, stablecoins were introduced - one of the more important innovations that happened in the cryptosphere in a while. While some of the first stablecoin experiments are dead by now, in late 2017 the first real game-changer entered the arena: MakerDAO. MakerDAO is a decentralized autonomous organization within the Ethereum blockchain. Their mission is to create a stablecoin (DAI) which is pegged to the dollar. In the beginning, people were sceptical that such a system could work, but it actually survived a few crashes, proving itself robust enough. Also, despite the sheer amount of lines of code of the underlying smart contracts, there has been almost no security incident so far. MakerDAO became the frontrunner for a new paradigm: decentralized finance or short DeFi .

In the beginning of 2019, MakerDAO really took off when developers started to use the DAI to build applications.

compound.finance is a platform to earn interest by lending out your crypto assets.

Nexus Mutual is an insurance against smart contract failures.

With Tinlake Centrifuge you can turn non fungible assets into loans.

To picture the state of adoption: as the time of writing, over a billion dollar has been circulating in DeFi products.

Scale Ethereum

Having real-world apps now using Ethereum on a day to day basis is also helping to evolve the underlying technology. To fix the scalability problem, great improvements have been rolled out in the Istanbul hard fork at the end of 2019:

Create interoperability with Zcash.

Facilitate cheaper and more performant layer-2 scaling and privacy solutions via zk-SNARKS/zk-STARKS.

Align gas costs of EVM opcodes with their computational costs (resource consumption) and make the network more resilient against denial-of-service attacks.

Allow more creative functions for smart contracts.

To fix the electricity and scalability problem, Ethereum will eventually switch from the Proof of Work consensus algorithm to Proof of Stake, where the network stakes direct economical value to protect it from malicious players. If all goes well, this will happen somewhen in 2020.

We need more gas

Onboarding new users to DeFi has been a quite painful experience. In the beginning you'll have to go through a know your customer (KYC) process to exchange fiat money to get some DAI but when you have them you'll also need some Ether to pay for the gas (the fuel that runs a smart contract). There are wallets like argent who are subsidizing the transaction costs for you so you don't have to worry about the gas. There have been significant efforts of the community to ease that pain, and one of the best efforts is the Gas Station Network, where a relay can cover the costs for the gas needed. The mosendo wallet went even one step further and found a mechanism to pay gas using DAI (by introducing a permit function in the ERC20 contract).

A thriving developer ecosystem

Despite being the largest smart contract blockchain, Ethereum shines on having the largest developer ecosystem as well. It's roughly 4x bigger and more active than its direct competitors like EOS, which unfortunately has a sub par user experience, or Tezos, which from a academical standpoint is quite interesting but simply not having the same steam like Ethereum.

It also fun to build things with Ethereum since the developer ecosystem is quite mature. OpenZeppelin is an open source collection of solidity smart contracts ranging from simple authentication to a fully fledged ERC20 token. With Truffle you can easily kickstart your dApp using JavaScript (or event TypeScript) - if you want 100% test driven development. If you want to take a sneak peak how the big guys are doing it. Many dApps are open source like MakerDAO itself or Uniswap (a decentralised exchange).

We believe that all these factors will result in a new breed of Ethereum apps:

Transactions costs converge to zero

With a stronger network and technical innovation happen in multiple layers of the blockchain the transaction costs will converge to zero. Since each transaction could carry a payload you can rebuild things like notary or decentralised IoT data warehouses.

Streaming m0ney

Payments cycles are inventions from a time where the costs of managing transactions have been high. Going full automation with smart contracts and eliminating all the middleman a lot of applications can be done differently. Imagine sending money to underdeveloped regions. If you send too much, people might abuse it and spend chunks on different things than agreed on. If you send it in too little chunks, then remittance fees will eat up the pie. Just pay what's needed today, e.g. pay electricity as it's consumed. Streaming money will allow us to pay based on real demand. Sablier Finance or Oasis are already doing such things.

Realtime Finance

Realtime finance will give us greater insights into market mechanisms. Why having central banks controlling base interest rates when smart contracts and decentralised networks can do that in an automated manner. That might sound like a dystopian future where people are not needed anymore, but we believe that these things can happily coexist. MakerDAO e.g. has a great human driven governance process where the risk parameters are controlled by the community. Think of a country that has fully digitalised his currency so all transactional data can be analysed at all times.

It's exiting times ahead!

So start building your business on Ethereum today. And if you need a helping hand no matter if it's Solidity, Truffle, or React — leave us a note using the following form:

Disclaimer: This posts is not mentioned as financial advice. As time of writing Ether has rallied hard and it probably won't last forever so don't join the bandwagon because you're speculating on higher prices. At 9elements we do own some Ether, DAI and also some MKR tokens but rather out of technical curiosity rather than an investment.

Ethereum Photo by clifford photography